ThreadCount Provisions: A Practical Guide to Clothing Inventory Management Software

Introduction

In a market where trends change fast and stockouts or overstocks directly harm margins, clothing inventory management software is no longer optional it’s a strategic advantage. The right system does more than track SKUs it connects point-of-sale, e-commerce platforms, warehouses, and buying teams so decisions are driven by accurate, timely data. For apparel retailers, complexity comes from size/color matrices, seasonality, returns, and multi-channel sales. That means your inventory solution must understand garment attributes, bundle/kit logic, and predictive replenishment. This guide explains why clothing-specific inventory platforms matter, which features truly move the needle, how to implement them so staff adopt and processes improve, and how to measure return on investment. Throughout I emphasize evidence, practical experience, and verifiable claims the E-E-A-T approach Google favors so you’ll also find tips for documenting results and establishing credibility with stakeholders and search engines alike.

Why clothing inventory management software matters

Apparel inventory is uniquely complex: each style often has multiple sizes and colors, seasonal lifecycles, and variable return rates all of which amplify forecasting and fulfillment challenges. A dedicated clothing inventory platform centralizes SKU variants and tracks inventory across locations and channels, reducing both stockouts that lose sales and overstock that ties up cash. Beyond counts, modern systems capture sell-through rates by size and color, flagged slow movers, and age-of-inventory reports that let merchandisers act before markdowns escalate. They also integrate with suppliers for automated reorder points and with e-commerce tools for real-time availability at checkout, improving customer experience and reducing cancellations. For boutiques and multi-store chains alike, the data produced enables smarter assortments, more accurate buying, and adaptive pricing strategies. In short, the right software converts messy, time-consuming manual work into measurable operational gains: higher turnover, lower carrying cost, and a more consistent customer experience.

Key features to look for in apparel inventory platforms

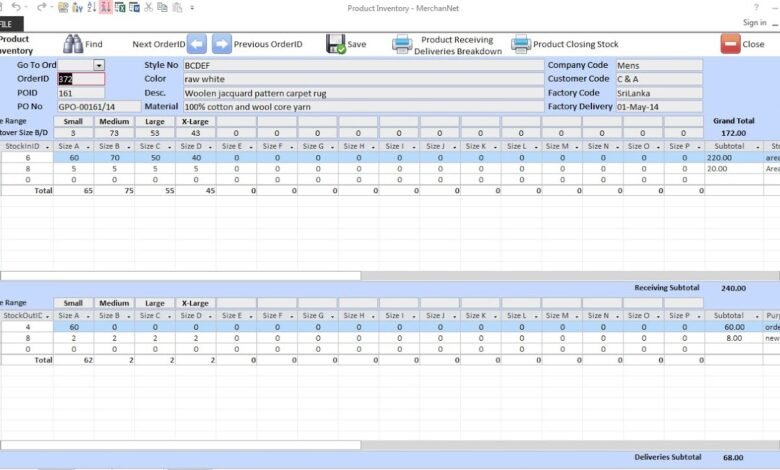

When evaluating software, prioritize features that map to apparel realities. First, robust variant management must handle size/color matrices, seasonal attributes, and style families so a single style can be tracked across many SKUs. Second, omnichannel synchronization ensures online and in-store stock counts match in real time, preventing oversells. Third, demand forecasting tailored to fashion seasonality and promotions helps set reorder quantities and timing; generic algorithms often underperform for apparel. Fourth, returns and exchanges workflows are critical: the system should rapidly return items to sellable stock or route them through quality checks. Fifth, integrations matter POS, e-commerce, 3PLs, and supplier portals must connect easily to avoid manual spreadsheets. Additional value comes from analytics dashboards, mobile scanning for stocktakes, barcode or RFID support for speed, and user roles for buying, store operations, and finance. Finally, look for configurable alerts (low stock, aging inventory) and audit trails that improve traceability and compliance.

Implementing clothing inventory software successfully

Successful implementation requires planning beyond software setup: align people, processes, and data. Start with a phased rollout pilot one store or category first to validate configurations for variant rules, reorder points, and workflows. Clean and standardize your master data before migration: consistent product codes, size charts, and cost fields prevent downstream errors. Train teams with role-based sessions and quick reference guides that show everyday tasks (receiving, transfers, returns, stocktakes). Automate where possible barcode scanning and EDI with suppliers reduce manual entry mistakes. Establish KPIs at launch (inventory accuracy, stockouts, sell-through, days-sales-of-inventory) and track them weekly for the first 90 days to spot process gaps. Also build governance: who approves price changes, who adjusts cost, and how are stock discrepancies escalated. Finally, involve merchandising, operations, and finance early their buy-in ensures the system supports both top-line growth and margin control.

Measuring ROI and scaling as your brand grows

Quantifying return on clothing inventory software helps justify investment and guides scaling decisions. Measure direct metrics like shrinkage reduction, fewer stockouts (lost sales recovered), lower holding costs (reduced excess inventory), and time saved on manual processes such as cycle counts. Translate these into financial outcomes: increased gross margin due to fewer markdowns, improved cash flow from reduced inventory days, and labor cost savings from streamlined workflows. Use control periods (compare pre- and post-implementation months adjusted for seasonality) to isolate software impact. As you scale, revisit configurations: update reorder rules for new SKUs, leverage more advanced forecasting modules or machine learning features, and add integrations (3PLs, marketplaces). Also consider RFID for high-volume SKUs or centralized warehouse expansions to support omnichannel fulfillment. Regularly document wins and lessons learned that evidence supports continuous investment and aligns teams around measurable growth.

Conclusion

Clothing inventory management software is a strategic tool for any apparel business aiming to reduce waste, improve fulfillment, and make buying decisions with confidence. The right solution combines variant-aware tracking, omnichannel synchronization, tailored forecasting, and seamless integrations but success depends equally on disciplined data, clear processes, and staff adoption. By piloting thoughtfully, measuring relevant KPIs, and iterating as you scale, retail teams can convert inventory complexity into a competitive advantage. Prioritize providers that demonstrate retail experience, offer transparent case studies, and let you trial features against real operational data so claims translate into measurable business outcomes.

Frequently Asked Questions (FAQ)

Q: Is general inventory software sufficient for a clothing business?

A: For very small operations it might suffice, but apparel-specific needs size/color matrices, returns handling, and seasonality usually require a dedicated or configurable solution to avoid manual workarounds and inaccurate forecasting.

Q: How long does it take to see ROI?

A: Many retailers see measurable improvements within 3–6 months after go-live (reduced stockouts, faster cycle counts), but full financial ROI often crystallizes after a seasonal cycle as forecasting and reorder rules are optimized.

Q: Should I choose cloud or on-premises software?

A: Cloud solutions are generally preferable for retail: lower upfront cost, easier integrations, automatic updates, and better support for multi-location teams. On-premises may suit highly specialized or regulated environments but comes with higher maintenance overhead.

Q: How can I make sure staff adopt the new system?

A: Involve end users early, provide role-based training, create simple SOPs for daily tasks, and set short-term KPIs that reward correct usage (e.g., quicker receiving times, higher inventory accuracy).