Mastering Financial Success with Income Made Smart

In today’s fast-paced world, mastering your financial strategy is more important than ever. “Income Made Smart” is a multifaceted concept that offers various tools and guidance to optimize your earnings and make informed financial decisions. Whether you’re a financial analyst, entrepreneur, or freelancer, understanding how to leverage these resources can significantly impact your financial success. This post will provide a comprehensive guide on making smart income decisions, utilizing financial analysis tools, and maximizing your online income.

Understanding Income Made Smart

“Income Made Smart” is a term that resonates across different platforms and entities, each offering unique insights into financial optimization. From financial analysis guides to empowering entrepreneurs and freelancers, the common thread is the focus on smart income decisions.

What Does Income Made Smart Mean?

To different entities, “Income Made Smart” means various things. It’s a guide on optimizing earnings, a platform for financial analysis, and a resource for entrepreneurs looking to enhance their income streams. Despite these varied contexts, the essence remains the same—empowering individuals to make informed financial decisions.

The Common Thread

The unifying element among these entities is the emphasis on maximizing financial success through strategic planning and analysis. By understanding the different facets of “Income Made Smart,” you can better appreciate the holistic approach to financial empowerment.

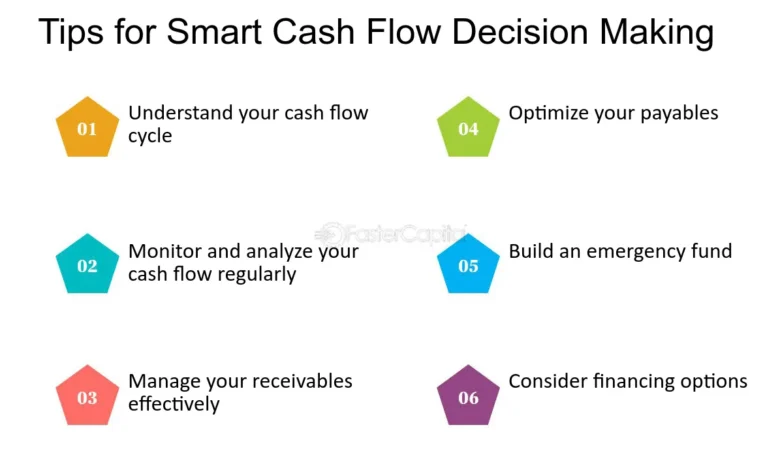

Strategies for Making Smart Income Decisions

Making smart income decisions involves leveraging various strategies and tools to enhance financial growth. Here are some proven methods to help you optimize your income.

Leveraging Financial Analysis Tools

Financial analysis tools are essential for both personal and business growth. These tools help you understand your financial status, identify opportunities for improvement, and make data-driven decisions. Tools like budgeting apps, investment trackers, and financial forecasting software can provide valuable insights into your financial health.

Insights from Income Made Smart Guide on Financial Assets

The “Income Made Smart” guide on Financial Assets offers practical advice for optimizing earnings. It emphasizes the importance of diversifying income streams, investing wisely, and continuously educating yourself about financial trends. Following these guidelines can create a robust financial plan that adapts to changing economic conditions.

Practical Advice for Entrepreneurs and Freelancers

For entrepreneurs and freelancers, increasing online income is a primary goal. Leveraging digital platforms, creating valuable content, and utilizing social media marketing are effective strategies. Additionally, focusing on building a strong personal brand and networking within your industry can open doors to new opportunities and collaborations.

Maximizing Financial Success as Presented in the Superstock Article

The Superstock article titled “Income Made Smart: Maximizing Financial Success In 2024″ provides various strategies for achieving financial success. Key takeaways include setting clear financial goals, regularly reviewing financial performance, and staying informed about market trends. Implementing these strategies can help you stay ahead of the curve and make smart income decisions.

The Role of Financial Analysts and Services in Income Made Smart

Financial analysts and professional services play a crucial role in helping individuals and businesses make informed financial decisions. Their expertise in financial planning and management is invaluable.

Contribution of Financial Analysts

Financial analysts use their skills to evaluate market trends, assess financial risks, and provide recommendations based on data analysis. Their insights can help you make informed decisions about investments, savings, and overall financial strategy.

Importance of Professional Advice

Seeking professional advice from financial analysts or services like IMS Decimal can significantly enhance your financial planning. These professionals offer personalized advice tailored to your needs, ensuring that you make the best possible decisions for your financial future.

Utilizing Financial Services

Services like outsourced accounting and finance can streamline your financial processes, allowing you to focus on growth and development. By entrusting these tasks to experts, you can ensure accuracy and efficiency in your financial management.

Conclusion

Mastering financial success requires a combination of strategic planning, informed decision-making, and leveraging the right tools and resources. “Income Made Smart” offers a comprehensive approach to optimizing earnings through financial analysis, practical advice for entrepreneurs, or professional services.

You can take control of your financial future by understanding the various facets of “Income Made Smart” and applying the strategies discussed. Remember to continuously educate yourself, seek professional advice when needed, and stay informed about financial trends. Your path to financial success starts with making smart income decisions today.